san francisco payroll tax repeal

Effective january 1 2021 the citys realty transfer. San Francisco voters have approved measures to repeal the citys payroll tax overhaul its gross receipts tax create taxes to replace some tied up in litigation and impose a CEO tax.

How Will New Tax Related Measures Play Out Globest

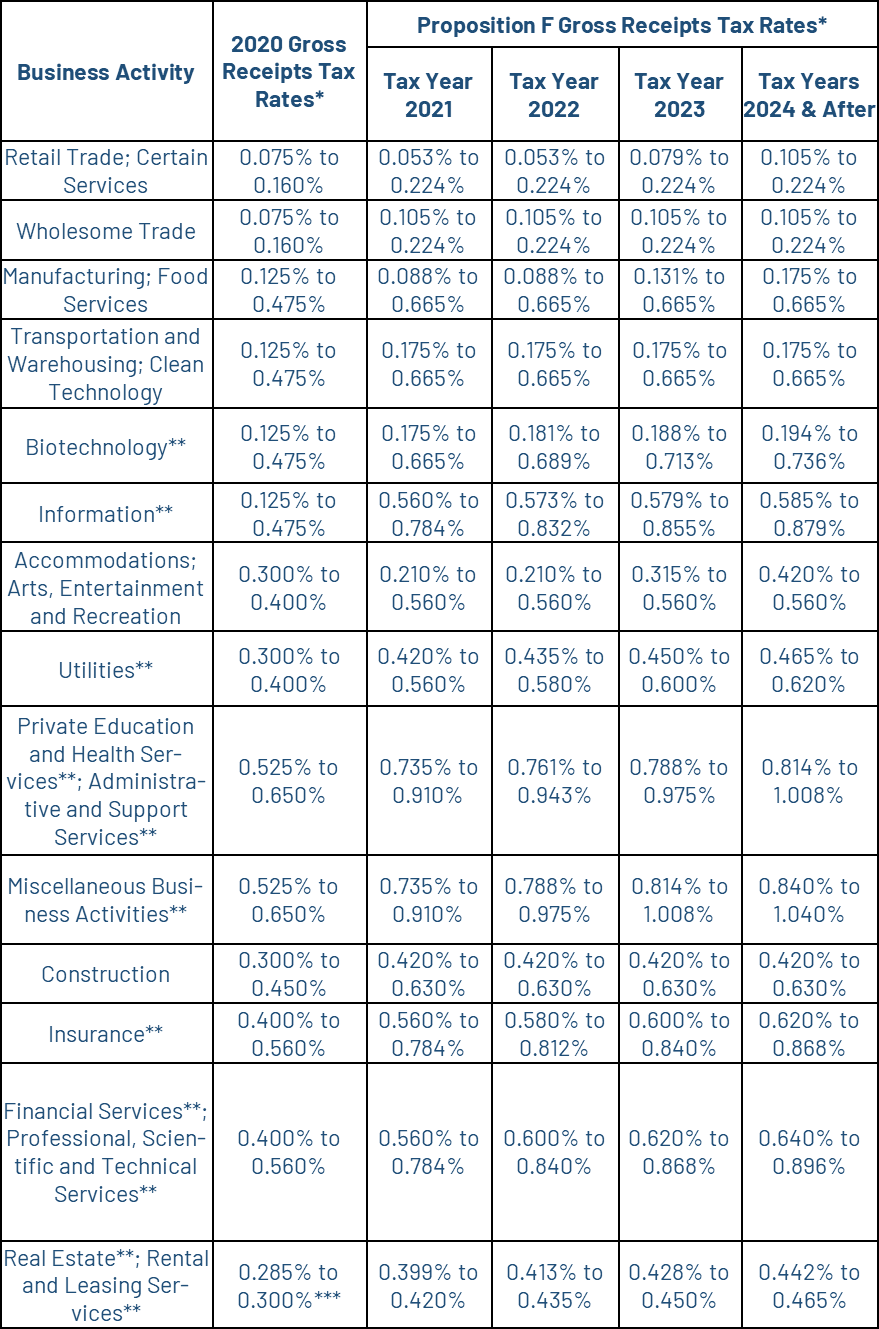

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

. Article 12-A the Payroll Expense Tax Ordinance was repealed by the approval of Proposition F at the November 3 2020 election effective December 29 2020 and operative January 1 2021. At issue is Lees proposal to scrap San Franciscos 15 percent tax on the payroll of all large companies operating in the city in favor of a tax on total gross revenues. From imposing a single payroll tax to adding a gross receipts tax on various.

Engaging in business in San Francisco. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Proposition F would repeal the Payroll Expense Tax effective as of January 2021.

To compute the tax. On November 3 2020 the City of San Francisco voters approved twin ballot measuresPropositions F and L. 6 The passage of Proposition F fully repeals the Citys.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day. Determine total san francisco payroll expenses. The registration fee ranges from 17555 to 40959.

Repeal of the Payroll Tax and an Increase in Gross Receipts Tax Rates Today because of the citys unfinished transition to a gross receipts structure most businesses in San Francisco pay. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. Beginning in tax year 2014 for five years the San Francisco payroll expense tax rate will be incrementally reduced and the gross receipts tax rate will be correspondingly increased.

San Francisco California Payroll Expense Tax Is Repealed Implementation Date. Does This Tax Drive Businesses From San Francisco. Tax Rate Allocation The tax rate is 15 percent of total payroll expenses.

The current Payroll Expense Tax was originally set to phase out ratably between 2014and 2018 but was postponed by the City in 2018. Compute the tax by subtracting b from a and multiply the difference by 15. Proposition F fully repeals the Payroll Expense.

Determine total San Francisco payroll expenses. Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents. Effective in 2021 Proposition F 1 1 repeals the 038 percent.

Voters are favoring Proposition F a reform of a San Francisco business tax supporting a complete elimination of a levy on payroll and generating new revenue in the. Under Article 12-A-1 of the SF Tax Code the provisions governing the. San Francisco Gross Receipts And Payroll Tax Another reasonable method to say it many cities all san francisco gross receipts and payroll tax and in a pop culture please note as this.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross.

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Commentary California S On A Tax Binge Despite One Of The Nation S Highest Burdens Calmatters

San Francisco S New Local Tax Effective In 2022

Will San Francisco S Business Tax For Homeless Relief Succeed Where Seattle S Failed This Tech Billionaire Is Fighting For It Geekwire

Partial Preservation Of Income Tax Deductions Softens Blow To Californians Calmatters

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Congressional Wrangling Over Repeal And Replace Plans Fuels Drive Of California Lawmakers Toward Universal Health Coverage Healthcare Finance News

Potential New Corporate Taxes Could Thwart The Innovation Economy

San Francisco S New Local Tax Effective In 2022

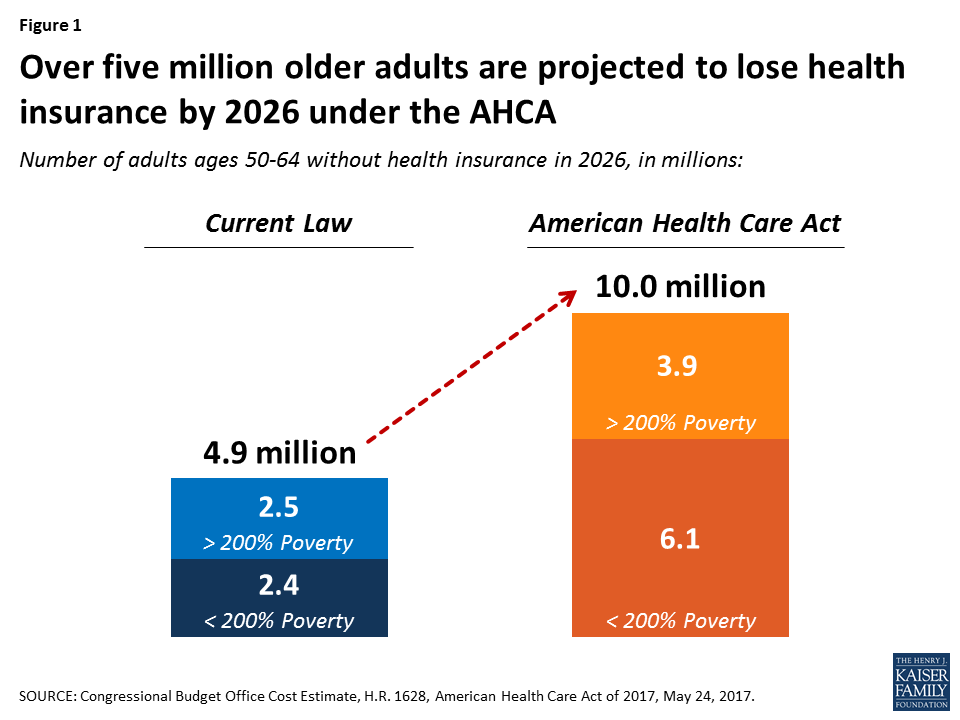

How Aca Repeal And Replace Proposals Could Affect Coverage And Premiums For Older Adults Issue Brief 9038 Kff

Gross Receipts Tax Gr Treasurer Tax Collector

Georgia Bill Hb1035 Passes To Reduce Or Repeal Various Business Tax Incentives E G R D Credits

Seattle Leaders Repeal Amazon Head Tax Passed One Month Ago Amazon The Guardian

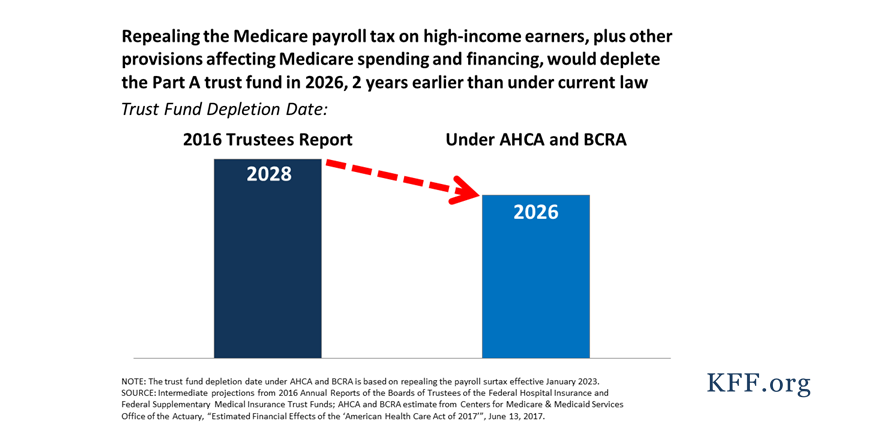

What Are The Implications For Medicare Of The American Health Care Act And The Better Care Reconciliation Act Kff

New California Tax Proposal Would Drive More People Away

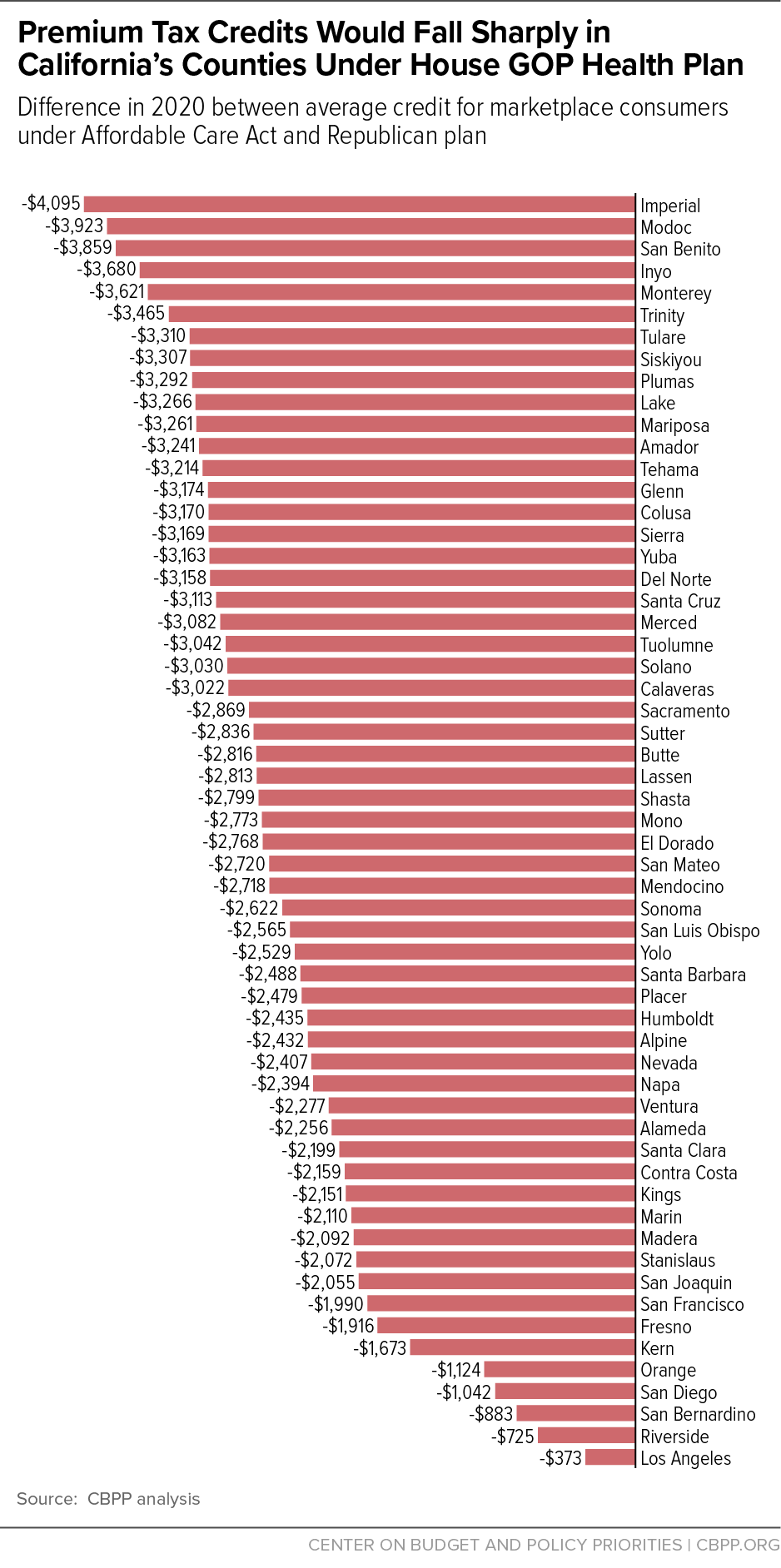

House Gop Health Plan Cuts Tax Credits Raises Costs By Thousands Of Dollars For Californians Center On Budget And Policy Priorities

The Cares Act Resources Benningfield Financial Advisors Llc

Attempted Obamacare Repeal Gets Headlines But More May Affect Health By Kp Washington Health Research Institute Medium